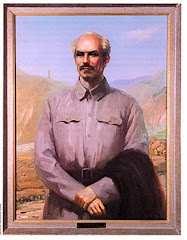

"The crisis has not yet hit the bottom, and it is hard to predict what other problems there will be down the path,” Wen Jiabao

I suppose one should consider Wen Jiabao carrying around a copy of Adam Smith's book, "Theory of Moral Sentiments," an improvement over carrying around Mao's "Little Red Book;" however, Adam Smith certainly does not explain capitalist economic depressions nor what comes after capitalism.

I do find it an interesting technique Wen Jiabao is using to throw talk about "moral sentiments" in the face of capitalists... however, we really need to be asking why he isn't also following up with an even stronger dose of Marxism.

Morality has never been a very powerful influence on capitalists in spite of all their studies of Adam Smith... we have seen capitalist "morality" in play in Gaza in recent days. We witnessed capitalist "morality" in what came with Hurricane Katrina.

One must suspect that Barack Obama in his studies at Harvard was likely to have very thoroughly studied Adan Smith's, "Theory of Moral Sentiments;" yet, Obama remained silent as the Israeli killing machine slaughtered hundreds in a shocking, modern day pogrom.

Wen Jiaboa is preaching to the capitalist hypocrites like those who used to wave Mao's "Little Red Book" of quotations in the fight against imperialism. All Wen Jiaboa has to do is add a few quotes from the Bible to make his dog-and-pony show complete and he will have an act fit to star in the center ring under the Big Top in the capitalist circus. Perhaps some clown will even toss a shoe at Wen Jiaboa's head to bring the act to conclusion before a gaggle of clowns comes in to allow him to leave the center ring to get us ready for the main act--- Barack Obama.

This is a very interesting comment coming from Wen Jiabao, the Chinese leader who is supposed to be a Communist.

This comment causes one to wonder if Wen Jiabao has ever studied Marxism because he demonstrates very little grasp of the capitalist economy in making this statement... and he demonstrates an even shallower understanding of Marxism in saying, in this interview, that he "thought things were beginning to turn around."

Wen Jiabao only would have to read basic Marxist texts like "Socialism: Utopian and Scientific" to understand the capitalist economy is coming crashing down in a depression which should enable Wen Jiabao to conclude that China will have to find solutions to its problems in expanding socialist democracy and the socialist economy rather then by collaborating with the imperialists.

Very troubling is Wen Jiabao's remark: "I want to make clear here that I will be most sincere in all my answers, but I may not tell you everything.

"May not tell you everything," is a very disconcerting comment coming from one who lays claim to being a Communist leader.

Why would any Communist refuse to tell working people in China or any place else in the world what he or she fully understands and knows?

Communists have never withheld the truth from working people... only the faux--- fake Communists, the revisionists and sellouts--- who find protection in cuddling up to capitalist politicians like Barack Obama and the Wall Street crowd pulling Obama's strings, rather than throwing in their lot with the working class proceed in such a dishonest manner.

In fact, it is relatively easy for any working class woman or man to figure out what is going on and just how desperate the situation is; a situation which a leader of the U.S. Federal Reserve Board has described as, "Not your garden variety recession."

In fact, to begin to understand what is going on with the capitalist economy we have to understand that this is not merely a "global economic downturn;" but, rather, a global capitalist economic depression of immense proportions from which capitalism is never going to "recover."

All the facts are there for Wen Jiabao, or anyone else to see, if they are open-minded enough to try to understand what is happening.

It will be virtually impossible for anyone to understand what is going on with the capitalist economy without turning to Marxism for answers simply because Karl Marx and Frederick Engels made the most exhaustive study of the capitalist economy.

One does not have to be a Communist to read and study what the Marxists have to say about economics; however, solving the problems capitalism has created is another matter.

The capitalists have reaped the profits and left the working class with poverty and problems... huge problems; the closer we examine the problems the reality is the larger the problems become.

Make no mistake, capitalism is on the skids to oblivion and humanity is now well along down the road to perdition.

Frederick Engels, Karl Marx' friend, colleague and comrade had this to say which very clearly defines what is happening to the capitalist economy today:

From: Frederick Engels's--- Socialism: Utopian and Scientific/ (part of his /Anti-Dühring/), is a description of the crisis of capitalism that seems uncannily appropriate to today.

* * *

Commerce is at a standstill, the markets are glutted, products accumulate, as multitudinous as they are unsaleable, hard cash disappears, credit vanishes, factories are closed, the mass of the workers are in want of the means of subsistence, because they have produced too much of the means of subsistence; bankruptcy follows upon bankruptcy, execution upon execution. The stagnation lasts for years; productive forces and products are wasted and destroyed wholesale, until the accumulated mass of commodities finally filter off, more or less depreciated in value, until production and exchange gradually begin to move again. Little by little the pace quickens. It becomes a trot. The industrial trot breaks into a canter, the canter in turn grows into the headlong gallop of a perfect steeplechase of industry, commercial credit and speculation, which finally, after breakneck leaps, ends where it began--in the ditch of a crisis. And so over and over again. We have now, since the year 1825, gone through this five times, and at the present moment (1877) we are going through it for the sixth time.... The fact that the socialised organisation of production within the factory has developed so far that it has become incompatible with the anarchy of production in society, which exists side by side with and dominates it, is brought home to the capitalists themselves by the violent concentration of capital that occurs during crises, through the ruin of many large, and a still greater number of small, capitalists. The whole mechanism of the capitalist mode of production breaks down under the pressure of the productive forces, its own creations. It is no longer able to turn all this mass of means of production into capital. They lie fallow, and for that very reason the industrial reserve army must also lie fallow. Means of production, means of subsistence, available labourers, all the elements of production and of general wealth, are present in abundance. But "abundance becomes the source of distress and want" (Fourier), because it is the very thing that prevents the transformation of the means of production and subsistence into capital. For in capitalistic society the means of production can only function when they have undergone a preliminary transformation into capital, into the means of exploiting human labour power.

Frederick Engels's---

Socialism: Utopian and Scientific/

part of his...

Anti Dühring/

New York: International Publishers, 1935, pages 64-65

Perhaps Wen Jiabao doesn't feel comfortable citing Frederick Engels for fear of offending his new found capitalist friends... however, if anyone believes this is not what is happening with the capitalist economy they should step forward with their reasons... Wen Jiabao failing to point this out is not helping anyone except a small grouping of capitalist who continue to cling to power simply because so many working people do not understand what Engels was writing about.

The problems are too big and far to complex for capitalism to resolve.

Hurricane Katrina exposed this; even though there are many who would like to dump all blame on George Bush.For sure George Bush was a big part of the problem; but, what hurricane Katrina and the aftermath demonstrated is that capitalism is simply not able to solve big problems in a way that is good for most of the people--- people who happen to be, in the majority, working people who are suffering. Katrina created the damage, but, Mother Nature was assisted in her rage by a very corrupt government which had abandoned taking care of public infrastructure as capitalists stole the wealth created by workers, thus preventing proper maintenance of dikes and canals, etc. And after the damage was done, there have been no resources to repair the damage and restore the community because capitalists are hoarding the wealth--- funds which should be available to rebuild after such a natural disaster.

Whether in the aftermath of Katrina or the many other problems now being experienced by people across the globe we are all confronted with a common problem: The tremendous wealth working people have created now belongs to the capitalist exploiters and we are confronted with the very problem Frederick Engels describes above which Wen Jiabao either is not familiar with like so many other people, or, this is one of those things he chooses not to talk about.

This is a very important interview; what is sad is that working people have to read between the lines and try to figure out what Wen Jiabao did not tell... fortunately, we can study Marxism for ourselves to learn what Wen Jiabao has apparently promised his new found capitalist friends he would not tell working people.

This is a very interesting article from the Financial Times and a very informative interview. I would encourage everyone to read, and re-read the article and interview.

I would suggest that in reading the article and interview that you repeatedly ask yourself: What is going to happen to the lives of working people on the way down to "the bottom;" and, do we really want to find out what is waiting for us "at the bottom?"

I do not use the word "perdition" loosely.

Make no mistake, capitalism is on the skids to oblivion and we are well down the capitalist road to perdition.

Wen Jiabao in stating, "it is hard to predict what other problems there will be down the path" would have been more accurate--- and honest--- in stating something like: try to imagine the problems before us on the capitalist path; whatever problems you might imagine, the problems are going to be much worse.

Alan L. Maki

[Note: The Full Transcript of the interview with Wen Jiabao from the Financial Times of London upon which the story below is based can be found at the end of this story.]

Downturn causes 20 million job losses in China

By Jamil Anderlini in Beijing and Geoff Dyer in London

http://www.ft.com/cms/s/0/19c25aea-f0f5-11dd-8790-0000779fd2ac.html?nclick_check=1

Published: February 2 2009

More than 20 million rural migrant workers in China have lost their jobs and returned to their home villages or towns as a result of the global economic crisis, government figures revealed on Monday.

By the start of the Chinese new year festival on January 25, 15.3 per cent of China’s 130m migrant workers had lost their jobs and left coastal manufacturing centres to return home, said officials quoting a survey from the agriculture ministry.

The job losses were a direct result of the global economic crisis and its impact on export-oriented manufacturers, said Chen Xiwen, director of the Office of Central Rural Work Leading Group. He warned that the flood of unemployed migrants would pose challenges to social stability in the countryside.

The figure of 20 million unemployed migrants does not include those who have stayed in cities to look for work after being made redundant and is substantially higher than the figure of 12 million that Wen Jiabao, premier, gave to the Financial Times in an interview on Sunday. Speaking on a visit to the UK on Monday, Mr Wen said there had been signs at the end of last year the Chinese economy might be starting to recover.

In a speech at Cambridge University later, he warned that the global economy could face further problems. “The crisis has not yet hit the bottom, and it is hard to predict what other problems there will be down the path,” he said. Governments should avoid any policies that allowed them to “progress at the expense of others”, he added.

Mr Wen’s speech was interrupted by a protester who called him a “dictator” and threw a shoe at the stage – an act reminiscent of the Iraqi journalist who threw shoes at George W. Bush, former US president, at a press conference in Baghdad last year. Police said they had arrested the man.

Production in China’s manufacturing sector declined for the sixth successive month in January, according to Hong Kong brokerage CLSA, which said on Monday that its purchasing managers’ index hit 42.2, up marginally from December but well below the no-change mark of 50.

This is the Full Transcript of the interview the story above with Wen Jiabao is based on.

Published: February 2 2009 10:51 | Last updated: February 2 2009 10:51

The interview was conducted by Lionel Barber, editor of the Financial Times

Wen Jiabao: I want to make clear here that I will be most sincere in all my answers, but I may not tell you everything.

Lionel Barber: Premier, when you were in Davos this week, and everybody was talking about how to restore confidence, there was also some talk about shooting bankers; that certainly will not restore confidence. What can China do today, in this global financial crisis, to restore confidence?

WJ: Yes, indeed, I attended the Davos WEF Annual Meeting, and paid a visit to the European countries. I want to call this trip a journey of confidence. I have brought with me confidence in tiding over the difficulties caused by the financial crisis. I have brought with me the confidence that China will work closely with the European countries to push forward our strategic partnership. And I have brought with me the confidence that China will work with the international community to get through the difficult times together.

I’m confident that the Chinese economy will be able to get through the difficult times caused by the financial crisis. This confidence has been based on a scientific approach, as well as the realities in today’s world, as well as in China. The source of my confidence is based on the correct judgment we have made of the current situation.

I feel confident, because over the past 30 years of reform and opening up, China has put in place a solid, material and technical foundation, and we have now in place good institutions and mechanisms.

I’m confident because China has a stable financial system. And also because China has a big market potential and a large room for manoeuvre.

Most importantly, my confidence is based on the decisive and firm decisions that the Chinese government has adopted. We took these decisions with great intensity and at a proper pace.

I think I have given you a sketch of what the Chinese government has done, and if you are interested in any details, I’m ready to answer any question.

LB: Is this stimulus package big enough? Or do you believe further measures will be needed?

WJ: In meeting the financial crisis, it is imperative that governments must adopt a big enough package plan to stimulate the economic development. Such a plan must be comprehensive and complete. It must target both the root causes and symptoms of the issues, and also take into account both immediate difficulties and long term development.

Our package plan has five key components.

Number one: we want to stimulate greater domestic demand that will be mainly supported by massive government spending.

Number two: we are making adjustment to, and revitalising ten key industries.

Number three: we will take steps to advance technical upgrading.

Number four: we aim to put in place a fairly comprehensive safety net.

And number five: we aim to preserve financial stability to support economic development.

Do you want me to cite some figures, or statistics of that?

We have an investment programme worth Rmb4 trillion within two years to stimulate domestic demand, especially consumer demand.

We will spend Rmb600bn on scientific and technical innovation and technical upgrading.

We will make an investment of Rmb850bn for the improvement of medical and health care system.

The financial crisis has not yet hit the bottom, and we will continue to follow very closely the development of the situation.

We may take further new timely and decisive measures…

All these measures have to be taken pre-emptively before an economic recession, so as to maximise the desirable effect, otherwise our efforts will be wasted.

LB: Did you see, as many economists in Asia witnessed, a very sharp decline in GDP in the fourth quarter in China, like falling off a cliff?

WJ: China’s GDP was at 9 per cent as a whole last year, but in the fourth quarter of 2008 we also had a big decline and it fell to 6.8 per cent. As a result of the international financial crisis, we are seeing the diminishing external demand.

Our businesses are now experiencing difficulties. We now have over capacity in some industries and also rising unemployment. Our economy is under increased downward pressure and all this means that we are now facing great difficulties. Maybe you will ask how come you still feel confident under such circumstances.

LB: How can you be so confident that you can magically hit that 8 per cent figure? And how can you stop all those statistical experts saying.

WJ: Well, I think this is dependent on four factors. First, we must ensure that all policy measures we have adopted are the right ones as well as the effective ones. So far all these policy measures we have adopted are aimed at stimulating the real economy and also stimulating spending.

Well, actually the major impact of the financial crisis on the Chinese economy has been on its real economy. Secondly, one must act fast. We started to take action from July last year and we started to adopt massive steps from October last year.

During last December the central government took the decision of making an investment of Rmb100bn and I can tell you now that this investment has been put in place in terms of real funds and on what projects the money will be spent. Before the Spring Festival we also made available another investment of Rmb130bn and the funds were disbursed to the necessary projects.

Thirdly, we must take forceful steps. Under special circumstances; necessary and extraordinary measures are required. We should not be restricted by conventions.

Success or failure depends on the pace and intensity of those measures. Fourth, we must make sure that these measures are effective ones.

Around the end of last year and early this year we took steps to make the household appliances, agricultural machinery, as well as automobiles more available to the rural areas of China.

From the beginning of January this year we started to undertake the transformation of the value added tax in China, which saved businesses in China Rmb120bn. All these measures have already been implemented.

LB: Consumer spending, Premier Wen, is crucial. Do you agree with the proposition that consumer spending is patriotic?

WJ: We would not put it as simply as that. I think that is a view that is maybe held by some media people or by some individuals.

But we do believe that consumer spending is vital in boosting economic development. I don’t think we can know how much a consumer will spend eventually, and whether he wants to spend is not dependant on what kind of slogan we have.

But it is really dependant on how much money he has in his pocket and whether we have those marketable products available. We have actually taken some steps to address this issue. At the beginning of this year we gave lump sum subsidies to 74 million people.

On average each will have Rmb100 to Rmb150. For the fifth time we have raised the pension benefits for enterprise retirees by 10 per cent and each one will have Rmb110. We have also increased the basic cost of living for people living in difficult circumstances and increased the special assistance and allowances for the groups who are entitled to them. We have also taken another step that is very difficult.

That is we have increased the wages for the 12m middle and primary school teachers who are in the compulsory education period in the Chinese educational system. We want to bring the wage level of those teachers up to the same level as the public servants.

I think people will be ready to spend when they have the money. We also took the policy that from January 20 2009 to December 31st 2009 there will be a policy of halving the purchasing tax of vehicles of 1.6 litre engines or below, and on the first day the policy was introduced it gave such a strong boost to the sales of automobiles on the Chinese market that even the inventories were all gone.

LB: Before I turn to the international aspects of this crisis I have one small question regarding rural China. You visited over 2,000 Chinese counties I understand? What specific measures are you taking to assure social stability as unemployment rises and many, many people are returning to the land? And within that question, one last question on the Agricultural Bank of China. Are you planning to use $800bn to recapitalise it.

Translator: The Agricultural Bank of China?

WJ: When I was Vice Premier of the State Council rural affairs in China were already a part of my portfolio, and since I became the Premier of the State Council I have always put rural affairs at the forefront of the government agenda in relation to the development of the Chinese economy.

As you said, the financial crisis has caused some bankruptcies of businesses and also made the migrant workers return to the countryside. In total we have about 12m migrant workers who have returned to the rural areas.

Some western countries may wonder whether this will be a source of social instability. Well, I want to tell you that in China we have altogether about 200m migrant workers working in the urban areas, and the population of migrant workers searching jobs across provinces is about 120m.

As I said, about 12m migrant workers have chosen to return to the countryside because of the financial crisis. As this is a floating population, it is easy to understand that they will come to cities when there are job opportunities there and they will choose to return to the countryside when there aren’t.

When they have returned to the countryside you can see that, for most of them, they still have their piece of land in the rural areas. I think land provides the most important safeguard for the lives of those farmers in China.

We should thank those Chinese migrant workers because they made an enormous contribution to China’s modernisation drive and, in times of this financial crisis, they have also become a big reservoir of the labour force.

With regard to the Agricultural Bank of China, this is the last bank among the five major commercial banks in China which is undertaking reform.

I want to point out one thing here, that it is largely because we started the reform in China’s banking sector about 10 years ago that now we have seen the Chinese major banks are now in a fairly healthy condition in terms of the quality and scale of their assets, the profitability of those banks, the proportion of NPLs (non-performing loans), as well as the flow of capital in those banks. We took these measures, including the reducing of non-performing loans in the banks, improving the corporate governance structure in the banks, as well as making them shareholding companies.

There are four key priorities in our reform with regard to the ABC. One is that we must ensure this reform will serve the purpose of agricultural development. Secondly, we must take continued measures to dispose of those non-performing assets. Number three, the government will take steps to inject capital into the bank. Fourthly, we will undertake the reform of putting in place a corporate governance structure. Our decision on this recapitalisation is about US$30bn

LB: You’ve outlined some important measures that China has taken to stimulate its economy but the world expects so much of China, and America in particular. This past year there was more pressure on China regarding the renminbi and the Treasury secretary referred to China “manipulating” its currency. Have you received assurances from President Obama that America will be more accommodating, and what do you say to those charges that you are manipulating your own money?

WJ: To allege that China is manipulating its currency exchange rate is completely unfounded. From the second half of 2005 we have started to conduct the reform in China’s exchange rate regime. With more than three years of the reform, the renminbi has appreciated by 21 per cent in actual terms against the US dollar and 12 per cent against the Euro.

Now we have in place a market based managed floating exchange rate regime with a reference to a basket of currencies. This regime is consistent with China’s actual conditions and meets China’s actual needs. I want to make very clear here that it’s to maintain the basic stability of the Chinese renminbi on a reasonable and balanced level.

It’s not only in the interests of China but also the world economy. It is in the interests of the efforts of the international community in overcoming the financial crisis. Many people have not come to see this point. If we have drastic fluctuations in the renminbi exchange rate it will only be a big disaster

LB: If I understand you, Premier Wen, you are supporting what the Chinese authorities said 10 years ago with the ruling out of a depreciation of renminbi?

WJ: I think I have made my point very clear. That is, we practise a managed floating exchange rate regime and we preserve the basic stability of the exchange rate on a reasonable and balanced level.

LB: Everybody understands that the current financial crisis was manufactured, if you like, in America. It originated in America. There were many mistakes made in terms of managing risk and regulation but what do you say to those who believe that a part of the problem is the imbalance in the world economy, with China’s $2 trillion of reserves?

WJ: I think such a view is ridiculous. I think the reason for this financial crisis is the imbalance of some economies themselves. They have for a long time had double deficits and they keep up a high level of consumption on the basis of mass borrowing.

In those economies the financial institutions have not been put under effective regulation and the financial institutions have reaped massive profits with a very high leverage ratio.

Once such a bubble bursts, the whole world has been exposed to a big disaster. China is a very big developing country, with 1.3bn population.

The per capita GDP of China is only 1/16th of that of the UK. We do need a large pool of financial resources to achieve economic development and improve the people’s livelihood.

I think that it is confusing right and wrong when people who have been overspending blame those who lent them the money. In Chinese there is actually a proverb expressing this kind of situation which proves the character in the Chinese novel, Journey to the West, Zhu Ba Jie.

The proverb means to blame those who have actually done you a favour for your own wrongdoing. Well, when I shared this view of mine with the business leaders at Davos, they agreed with me on this.

LB: Premier, you're still going to buy US Treasury bonds, I hope.

WJ: Well, this is indeed a very sensitive issue. We do have very big foreign exchange reserves, and these reserves must be well run. Buying foreign Treasury bonds is one way of running these massive reserves. But as to whether we will continue to buy the Treasury bonds, and how many we are going to buy, I think we need to take into consideration China's own needs, and also the need that we must maintain the safety and the good value of our foreign exchange reserves.

We want to see the turnaround, or the recovery of the US economy. We believe that to maintain a stable international financial market is in the interests of shoring up market confidence, overcoming the financial crisis, and facilitating early recovery of the international markets.

LB: Would China be prepared to support the calls in some quarters for some of the reserves to be recycled through the IMF in return for the necessary award of greater votes for China in the IMF to help to manage this global financial crisis?

WJ: We believe it is imperative that we should first undertake reform in international financial institutions, including the IMF. And through the reform, we should increase the voting share, the representation, and the say of developing countries. At the same time, the oversight of how the capital at international financial institutions is used should be strengthened.

LB: I asked the question because for 30 years some people have said capitalism will save China, and now maybe people are saying China must save capitalism.

WJ: Well, I don’t see it this way. I still have a very clear mind on this particular point. China remains a big developing country with a 1.3bn population. We do face arduous tasks, and our way ahead will be a long one.

If you have seen the Chinese cities in the coastal areas, maybe you don't see much a difference between those cities and London, but if you have ever been to China's rural areas, particularly the western areas of China, you will see a big gap.

I firmly believe that running our own affairs well is the biggest contribution to entire mankind. I think there are three must-dos. First, we must address both the symptoms and root causes of the problem. One should not only tend to the head when the head aches, or tend to the foot when the foot hurts. We must enhance cooperation rather than enter into a confrontational relationship. We must run our own affairs well respectively, instead of shifting troubles to others.

LB: Premier Wen, did President Obama offer some assurances in this respect?

WJ: It has not been long since the inaugural speech of President Obama. We have been following closely the statements made by the new US administration. We look forward to early contacts with the new US government, and we believe that to maintain cooperation between China and the United States serves world peace, stability and prosperity.

LB: With respect, Premier Wen, just to press you, so it's not correct - some reports have said that President Obama has given a personal message reassuring China that the renminbi and other matters will not be used in an aggressive way; that America will be more accommodating? There's no personal message?

WJ: In his telephone conversation with President Hu Jintao the day before yesterday, he expressed his readiness to enhance cooperation with China. Yet, at the same time, we do see there are different voices within the United States itself. I hope the FT can convey a message from me to the US side. We want to enhance cooperation with the United States to meet the financial crisis together as that represents the larger interest, and it serves the fundamental interests of both countries.

LB: Yes, the problem may be even more in Congress than in the administration. So do you have a message for Congress?

WJ: We don't comment on the system of the United States. I think the US government has a decisive role to play in making the right decisions. The US government should view its relations with China from a long-term and strategic perspective, and under the current circumstances, the priority of the two countries should be working together to fight the financial crisis and promote the constructive and cooperative relations between China and the United States.

LB: Just to return to the reserves very quickly. Did I understand that the Chinese government may use some of the reserves for spending programmes at home to stimulate the economy?

WJ: Foreign exchanges reserves reflect the economic strength of a country. We are now studying how we can make the best use of the foreign exchange reserves in China. On this particular topic, you are all experts. And for banks, I think foreign exchange reserves are liabilities of the central bank, and if a government wants to make use of the foreign exchange reserves, it has to issue government bonds to buy the foreign exchange reserves.

We are now having discussions about how to make rational and effective use of the Chinese foreign exchange reserves to serve the purpose of economic development in China. Last year, we issued Rmb1.5 trillion of government bonds in purchasing US$200bn of foreign exchange reserves to inject capital into the China Investment Corporation.

Foreign exchange must be spent overseas, and it will be spent mainly on foreign trade and investment. Therefore, we want to use foreign exchange to buy the much-needed technology equipment and products. That is a quite technical issue.

LB: The world expects so much from China. China is taking very important steps to increase research and technology on renewable energy. But later this year, there will be a summit in Copenhagen on climate change. Is China ready to sign a treaty to cap carbon emissions?

WJ: I had a thorough discussion about this issue with President Barroso of the European Commission in Brussels the day before yesterday. The Chinese position on this issue is as follows.

Number one, China supports the Copenhagen conference. It supports all measures which are playing their roles in meeting the challenge of climate change, and we support the development of a green economy. We are of the view that to develop a green economy is probably another area in the economy as we meet the international financial crisis.

Number two, the Chinese government gives top priority to meeting the challenge of climate change. We have established a national leadership group on tackling climate change, and I'm head of the group.

We have formulated a national programme on coping with climate change, and this is not only the first programme of its kind for China, but also the first one of its kind among all developing countries.

In China's 11th five-year plan, we have set ourselves obligatory targets in saving energy and reducing pollution. The target requires us that we must reduce the per unit GDP energy consumption by 4 per cent every year, and in total by 20 per cent in five years.

We failed to meet the targets in the first two years of the five-year period, and we succeeded in meeting the target in 2008. We will continue to make efforts on this front and set targets for ourselves. I think this can be seen as a way that China is holding itself accountable to the relevant targets.

Number three, it's difficult for China to take quantified emission reduction quotas at the Copenhagen conference, because this country is still at an early stage of development. Europe started its industrialisation several hundred years ago, but for China, it has only been dozens of years.

China has a 1.3bn population, and in terms of per capita greenhouse gas emission, we are certainly not the biggest one, yet we are still very active and positive about our cooperation with Europe in terms of saving energy, reducing pollution, developing a low carbon economy, and developing those environmentally friendly technologies.

LB: Premier Wen, I've been told if I ask a political question, I have to be very careful.

WJ: Ask any question you want.

LB: I have to be careful, because [according to the saying in] Mandarin, I will get hat, shoes and gloves. But looking to the future, could you imagine there being direct elections to the National People's Congress, say, in ten years?

WJ: Well, actually, I think economic life and political life are not separable from each other. Let me address this political question from you from an economic perspective. We are undertaking both economic restructuring and political restructuring, and both are very important.

Without the successful political restructuring, one can't ensure success in our economic restructuring. The goal in our political restructuring endeavour is to promote socialist democracy, and better ensure people's rights to democratic election, democratic decision making, democratic management, and democratic supervision.

The society that we desire is one of equity and justice, is one in which people can achieve all round development in a free and equal environment. That is also why I like Adam Smith's Theory of Moral Sentiments very much.

In 1776, Adam Smith wrote the Wealth of the Nations. And in the same historical period, he wrote the Theory of Moral Sentiments. Adam Smith made excellent arguments in his Theory of Moral Sentiments. He said in the book to the effect that if fruits of a society’s economic development can not be shared by all, it is morally unsound and risky, as it is bound to jeopardize social stability .If the wealth of a society is concentrated in the hands of a small number of people, then this is against the popular will, and the society is bound to be unstable.

Like truth is the primary virtue in thinking, I have always believed that justice and equity are the primary virtue in the socialist system. In the eyes of the West it seems that the Chinese are afraid of democracy or elections. Actually, this is not true.

As I told the press during the press conference of the NPC session early last year, I said that only when people trust you, will they support you in your office. Now we have direct elections at village level and also direct elections of People’s Deputies at township level. At the same time, I have always believed that if the people have the ability to run the village affairs well they are capable of running the township affairs and the county affairs and then running the provincial affairs. In this entire process we should take a step by step approach in the light of China’s own conditions and to develop a democracy with Chinese features.

LB: So there’s a bit more room for democracy and a bit more room for dissent as part of a democracy?

WJ: Well, I don’t think a government should feel afraid of its own people. I think it should create opportunities for the people to better hold the government accountable.

LB: Premier Wen, I realise we’re running short of time. I had my own quote from the Theory of Moral Sentiments.

WJ: Well, I think for quite some time this book has not attracted due attention or attention that it deserves. I think it is as important as The Wealth of Nations. He made a reference to the invisible hand only on two occasions in these books. One, he refers to the market; the other, he talks about the morality. And please go ahead with your quote.

LB: “How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortunes of others and render their happiness necessary to it, though he derives nothing from it except the pleasure of seeing it.”

WJ: I think this is very well said, and I have been reading the book and this book I carried with me in my suitcase on the trip.

LB: Thank you very much for agreeing to talk to the Financial Times. It’s been very enlightening.

WJ: Thank you.